Kim Heng Offshore & Marine Holdings Ballot Results

Shares will start trading at 9am on 22 Jan 2014.

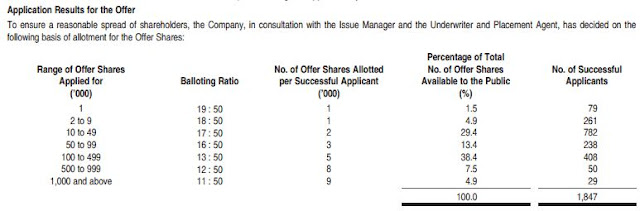

Results of the IPO as follow

Shares will start trading at 9am on 22 Jan 2014.

Results of the IPO as follow

- 5.8x oversubscribed

- 280x oversubscribed in offer (public) tranche

- 1x subscription for placement shares

Comments on latest OUE C-REIT IPO

We have a BUY call on the latest OUE C-REIT IPO with an eye for the long run (horizon). Expect volatility in prices as US tapering exercise goes into full swing and as OUE C-REIT begins negotiating renewal of rents. Read full article on healthtrading here.

IF YOU ARE UNDECIDED, SG IPO Statistics page will show you how the IPO demand and supply has been from 2012 onwards.

IF YOU WANT TO APPLY, do check out Guide to IPO Investing. The deadline is Noon 23 Jan! Hurry.

Lastly, do follow HealthyTrading on Twitter! We are live on Twitter! Follow to get updated financial news with a Singapore perspective for your investment and trading ideas.

-->